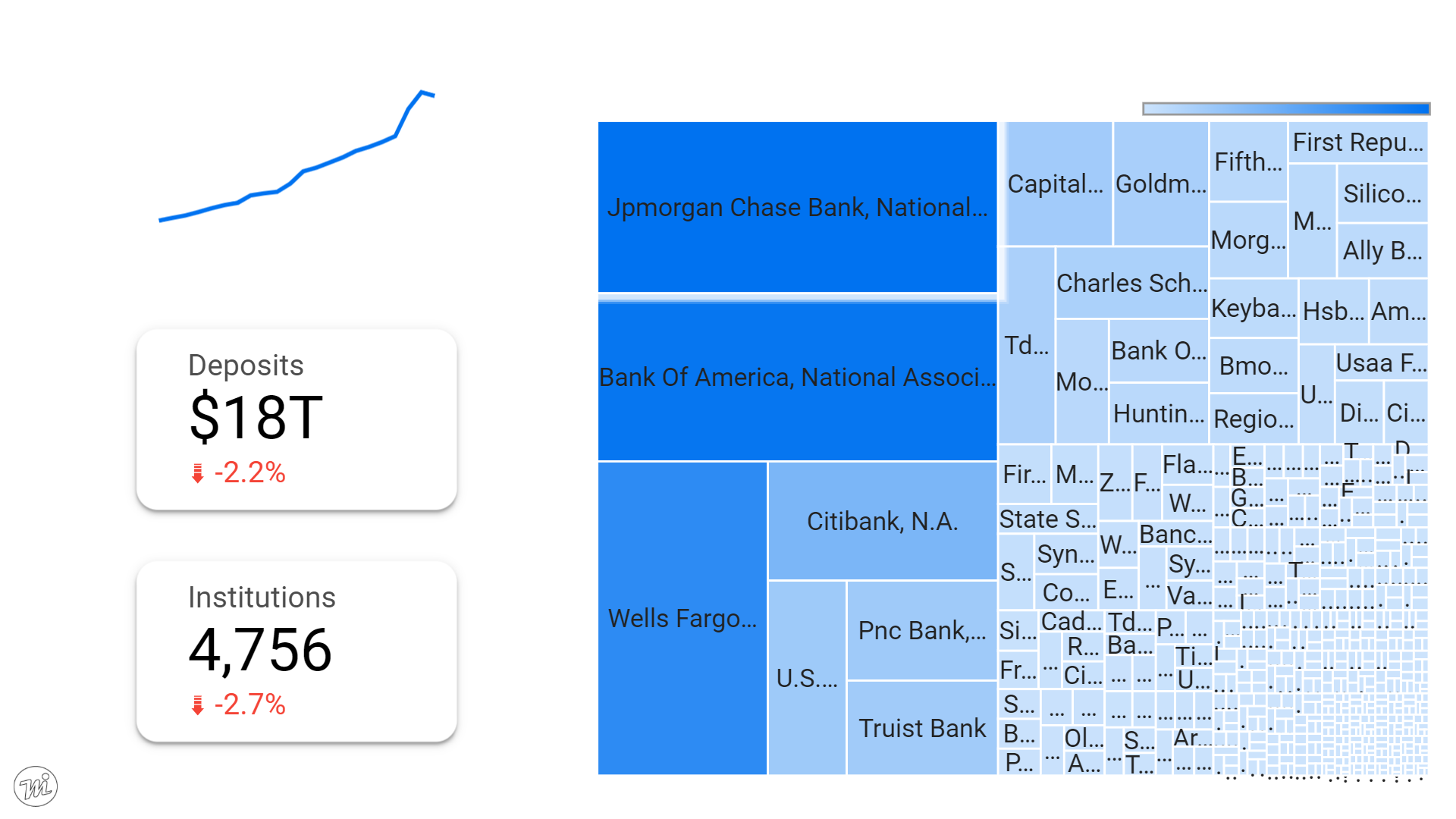

Half of deposits controlled by 10 banks in 2022. Why it matters.

Deposit market share is a measure of the size of a bank or thrift institution relative to the total amount of deposits held by all banks and thrifts in a given market. It is calculated by dividing a bank's or thrift's total deposits by the total deposits of all banks and thrifts in the market.

Deposit market share is an important measure of a bank's or thrift's financial strength and stability. Banks and thrifts with a large deposit market share are generally considered to be more stable than those with a small deposit market share. This is because banks and thrifts with a large deposit market share have access to a large pool of funds that they can use to make loans and investments.

Deposit market share is also an important measure of a bank's or thrift's competitive position. Banks and thrifts with a large deposit market share are generally in a better position to attract new customers and retain existing customers than those with a small deposit market share. This is because banks and thrifts with a large deposit market share are able to offer lower interest rates on loans and higher interest rates on deposits than those with a small deposit market share.

Treemap - Deposit market share by financial institution

What does a high deposit market share mean?

A high deposit market share generally means that a bank or thrift is financially strong and stable. It also means that the bank or thrift is in a good competitive position.

Banks and thrifts with a high deposit market share are generally able to attract new customers and retain existing customers. They are also able to offer lower interest rates on loans and higher interest rates on deposits than those with a small deposit market share.

What does a low deposit market share mean?

A low deposit market share generally means that a bank or thrift is not as financially strong or stable as those with a high deposit market share. It also means that the bank or thrift is not in as good of a competitive position.

Banks and thrifts with a low deposit market share may have difficulty attracting new customers and retaining existing customers. They may also have to offer higher interest rates on loans and lower interest rates on deposits than those with a high deposit market share.

How banks may increase deposit market share

There are a number of things banks may do to increase deposit market share:

- Offer competitive interest rates on loans and deposits

- Provide excellent customer service

- Expand your branch network

- Invest in marketing and advertising

- Develop new products and services

By taking these steps, banks may increase deposit market share and improve financial strength and stability.